Capitalize on Capital Gains

If only taxes were as simple as paying a percentage of your steady income into the IRS. The more complex your financial profile gets the more things come in to play when you file at the end of the year. One thing that can add to the complexity is capital gains or losses.

A capital asset is a property you own, whether it be a house, car or even stocks and bonds. The net gain or net loss of that asset occurs when you decide to sell and if the selling price was more or less than the value of the asset at the time you acquired it.

Capital gains and losses are taxed differently depending on how long you had them before you decided to sell.

Short-Term

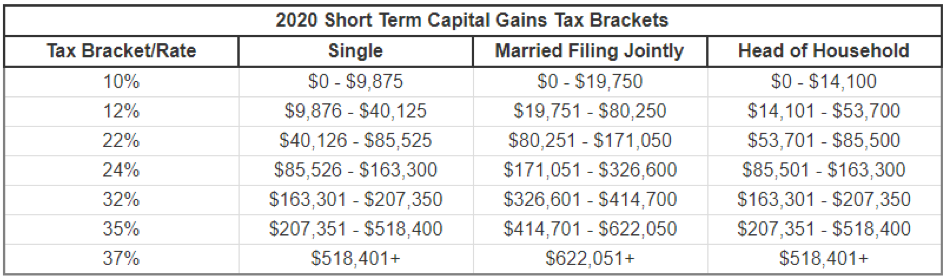

If you hold onto your asset for a year or less, this is considered short term. That profit or loss is then considered part of your regular income and is taxes within the appropriate bracket based on your income and filing status.

Long-Term

Once you hold onto an asset for more than a year it’s subjected to a different set of taxation rules with only three brackets taxing the asset at 0%, 15%, or 20%. Generally, most of us will be taxed at either 0% or 15%.

Long-term is better than short-term for tax purposes.

The numbers speak for themselves; long-term assets are subjected to MUCH better rates than short-term. We have no way of knowing how long these rates will stay in effect. If and when the political focus is on the middle class instead of the wealthy, we suspect this might change. As it is right now if you are able to hold onto that asset for over a year you’re going to see a greater profit overall because you won’t lose quite so much to Uncle Sam.

Losses carry forward.

To know where you stand for the year, you need to first combine all the losses and gains you’ve accrued from selling assets. This includes any loss carryover from prior years. Once combined, if the net is negative (or a loss) you can only claim a $3,000 loss each year until the loss is used up.

For example, In 2017, Mary sold stock with a total loss of $15,000. When filing her 2017 taxes, she was able to claim a max $3,000 loss leaving her with a carry-over loss of $12,000. Then, in 2018 she sold more stock and profited $5,000. The combined net value is now a $7,000 loss. When Mary files her 2019 taxes, she will be able to take another max loss of $3,000 which will make her carry over balance into 2021 a $4,000 loss.

Planning can help. You can sell useless stocks to try and offset the other gains in the year. This is a strategic move worth talking over with your financial advisor.

Know your basis, especially for inherited assets.

The tax basis is the value of an asset, used to compute gain or loss. Inherited assets are subjected to a step-up in basis. A step-up in bases means that the inherited asset is now assessed at current fair market value instead of the value at the time of the original purchase.

For example, Mary’s mom passed away in June of 2019 and left Mary her house currently valued at $250,000. Mary’s mom bought the house in 1965 for $15,000. This asset is subjected to a step-up in bases which means, for tax purposes, the original value for Mary is now the value of the house at the time SHE received it ($250,000) and not at the time her mom bought it ($15,000). Mary held onto the house and spent over a year cleaning out her mother’s belongings.

At the time of the sale, the price increased to $275,000. This means, with no other considerations, Mary has a taxable gain of $25,000. If it weren’t for the step-up in basis, Mary would be looking at a $260,000 gain (selling price of $275,000 minus her mom’s original buying price of $15,000) which is why the step-up in basis rule is so beneficial to the beneficiary.

Additional expenses accrued during the home selling process such as real estate commission paid to the realtor, closing costs, repairs, etc. can be applied to the taxable gain and reduce the amount. Be sure you take every extraneous expense into consideration to maximize the reduction of taxable gain. We recommend you seek out help from a tax professional when going through this process.

Capital gains are a great way to have a large influx of money, but you want to be careful how you sell that asset to keep as much of that money in your pocket instead of the government’s. For greater details download our Capital Gains and Losses worksheet or schedule an appointment with one of our tax experts.

Looking for more information? Get our Capital Gains and Losses Handout.

Get Capital Gains and Losses Handout

Powered by Weatherby Media LLC